SMI

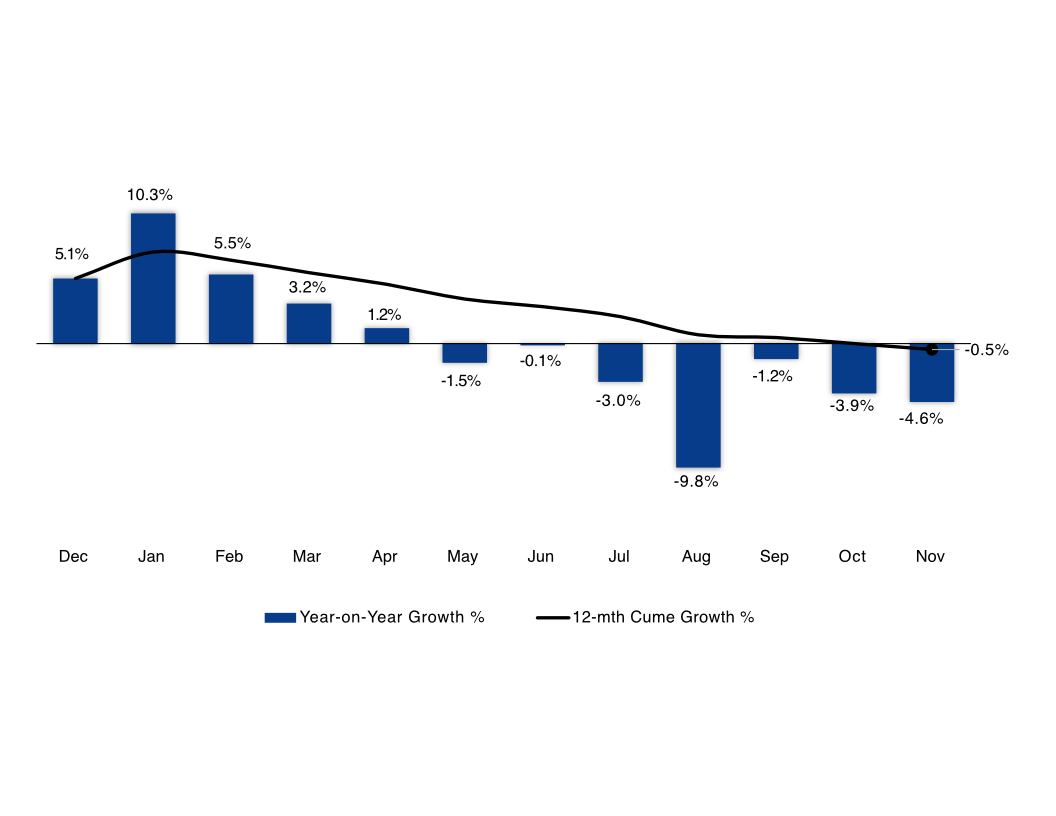

New Zealand’s media agency market softened in November last year, with total ad spend down 4.6% year-on-year to $107.1 million, Guideline SMI data shows.

However, calendar-year spend of $1.0 billion to November remained resilient, tracking just 0.9%, or $9.6 million, behind the first 11 months of 2024.

Key highlights are as follows:

- Outdoor bookings continue to surge, up 10.2% YOY to $23.2 million, (up almost 30% to $12.6 million) mostly due to strong growth in Billboards.

- Outdoor’s bookings outpaced those of linear TV for the first time in any November with TV’s total back 18% to $22.7m

- Radio demand remained solid, up 2.3% YOY

- Newspapers surged 75.9% YOY as Metropolitan totals more than doubled to $1.9 million. However we are double-checking this total as it mostly comes from one booking which may be for news media Digital assets

- Magazines spend grew 23.6%, buoyed by a significant lift in Newspaper Magazine inserts

- Digital spend was back 6.8% to $48.4 million as Display and Search posted declines

- Specialty Retailers, Government and Real Estate Development emerged as November’s strongest growth categories

- Product categories reporting weaker November totals included Media, Cosmetics, Utilities and Energy advertisers, including a 63% correction from Media advertisers, which spent just $1.1 million for the month (-$1.9m from November 2024’s record $3.1m total)

- For the CYTD, Radio is now up a healthy 10.6% compared with the same period in 2024; Outdoor has grown bookings by 13.0% and Magazine bookings have jumped 33.7%. Digital was flat but remained the biggest sector with $459.1 million, followed by Linear TV.